Fintensy

Transforming credit scoring into a fluid and instantaneous experience for both applicants and professionalsFintensy is a fintech group headquartered in Belgium, serving as the parent company of several innovative financial services, including Mozzeno, a platform specialised in collaborative lending. With a forward-thinking approach to finance, Fintensy continuously explores how technology and regulation—such as PSD2—can enhance…

“At Fintensy, our goal has always been to simplify and accelerate access to responsible credit. Exthand’s solution helped us do exactly that. Their API integration gave us reliable access to enriched financial data, which not only boosted the accuracy of our scoring models but also significantly improved the user experience. The integration was smooth, and their expert support has been consistently responsive and transparent, which is a real differentiator. Today, over 80% of our users choose to connect their bank accounts voluntarily. Exthand proved to be more than just a tech provider, they’ve become a real partner in our mission to make digital finance smarter, faster, and more inclusive.”

Frédéric Dujeux, Co-founder, Fintensy & mozzeno.com

Sector : Digital Financial Services

Solution : Financial Data Aggregation

Fintensy is a fintech group headquartered in Belgium, serving as the parent company of several innovative financial services, including Mozzeno, a platform specialised in collaborative lending. With a forward-thinking approach to finance, Fintensy continuously explores how technology and regulation—such as PSD2—can enhance credit processes for both consumers and professionals.

Their challenge?

Fintensy provides a wide range of innovative digital financial services. The fintech has set itself the challenge of improving data collection so that borrowers’ borrowing capacity can be assessed automatically, even more reliably and more quickly. All this while optimising the user experience to reduce constraints and make the various stages of the borrowing process more fluid.

As Fintensy expanded its digital lending services, it became clear that gaining reliable, efficient, and user-friendly access to financial data was crucial to streamline the application process, with a focus on :

- Optimising the bank connectivity coverage and ensuring redundancy in strategic regions.

- Maintaining cost efficiency for relatively low transaction volumes.

- Improving the quality and speed of their scoring models using enriched financial data

How did Exthand help Fintensy improve the reliability of its credit scoring and the experience of their users?

The project, step by step :

Since the arrival of PSD2, Fintensy has positioned itself in financial data analysis, working with partners to meet the specific requirements of the credit industry.

Step 1: Selecting the Right Partner

In evaluating Open Banking partners, Fintensy applied rigorous criteria:

- Quality of coverage across key European markets.

- Redundancy of strategic coverage to ensure uptime and resilience.

- Flexible pricing structures to accommodate fluctuating and relatively low volumes. Exthand stood out by offering strong geographical reach and a business model well-aligned with Fintensy’s growth path.

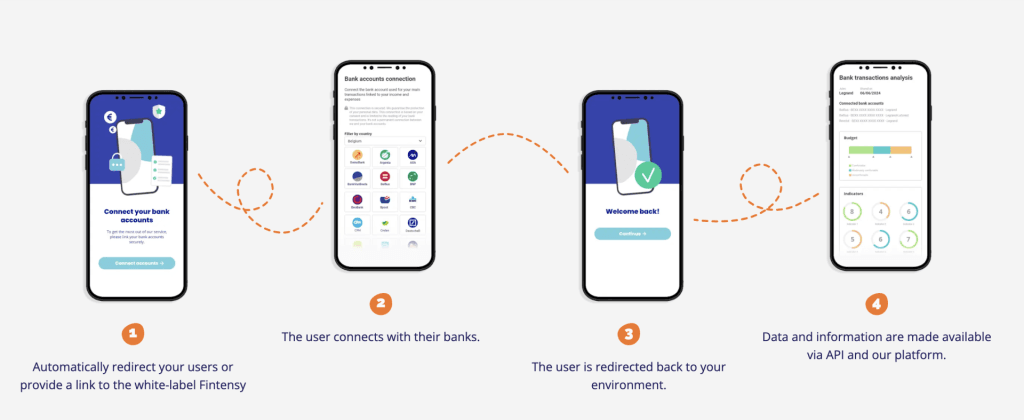

Step 2: Integration and Adoption

- Fintensy integrated Exthand’s API to facilitate seamless access to banking data. This allowed users to connect their accounts securely in a white-labeled user interface, enabling enhanced data-driven processes in applications such as Mozzeno.

- At the same time, Fintensy began the process of obtaining its own AIS licence, which will give them full control over the consent interface and further streamline the user journey.

Step 3: Embedding PSD2 in the Credit Process

The Exthand connection is used to retrieve key financial data, which is then cross-referenced and enriched with other technologies such as:

- itsme®, for fast and secure user authentication.

- OCR technology, for reading and verifying identity documents and payslips.

These tools, in combination, enable a near real-time credit application process—reducing delays for both users and back-office teams.

The solution: a smoother user journey added to fairer and faster credit decisions thanks to Exthand’s API.

At the heart of Fintensy’s mission is the ambition to make credit more accessible, transparent, and efficient—without compromising on security or compliance. By integrating Exthand’s Open Banking solution, Fintensy can offer a smoother and more intelligent credit journey, aligned with its commitment to innovation and responsible finance. The high-quality financial data retrieved via Exthand helps to create fairer, faster, and more personalised credit decisions, empowering both individual borrowers and professional users. In doing so, Exthand contributes directly to Fintensy’s vision of a more inclusive and tech-driven financial ecosystem.

Achieved results :

The implementation of Exthand’s API and the broader PSD2 strategy has delivered measurable impact:

- 60% of users prioritise bank account connection over manual upload.

- 82% of users voluntarily connect their bank accounts, despite it not being mandatory.

- The scoring model has significantly improved, thanks to the quality and completeness of data accessed via PSD2.

- The user experience is faster and more fluid, particularly due to pre-filled forms based on account data.

Fintensy also benefits from the technical strengths of the Exthand platform:

- High connection success rate across banks.

- Well-structured and clearly mapped data, easily usable for internal models.

- Responsive support and transparent communication.

- An intuitive debugging interface, which simplifies troubleshooting and monitoring of API calls.

The results :

- 60% of users prioritise bank account connection

- 82% of users voluntarily connect their bank accounts